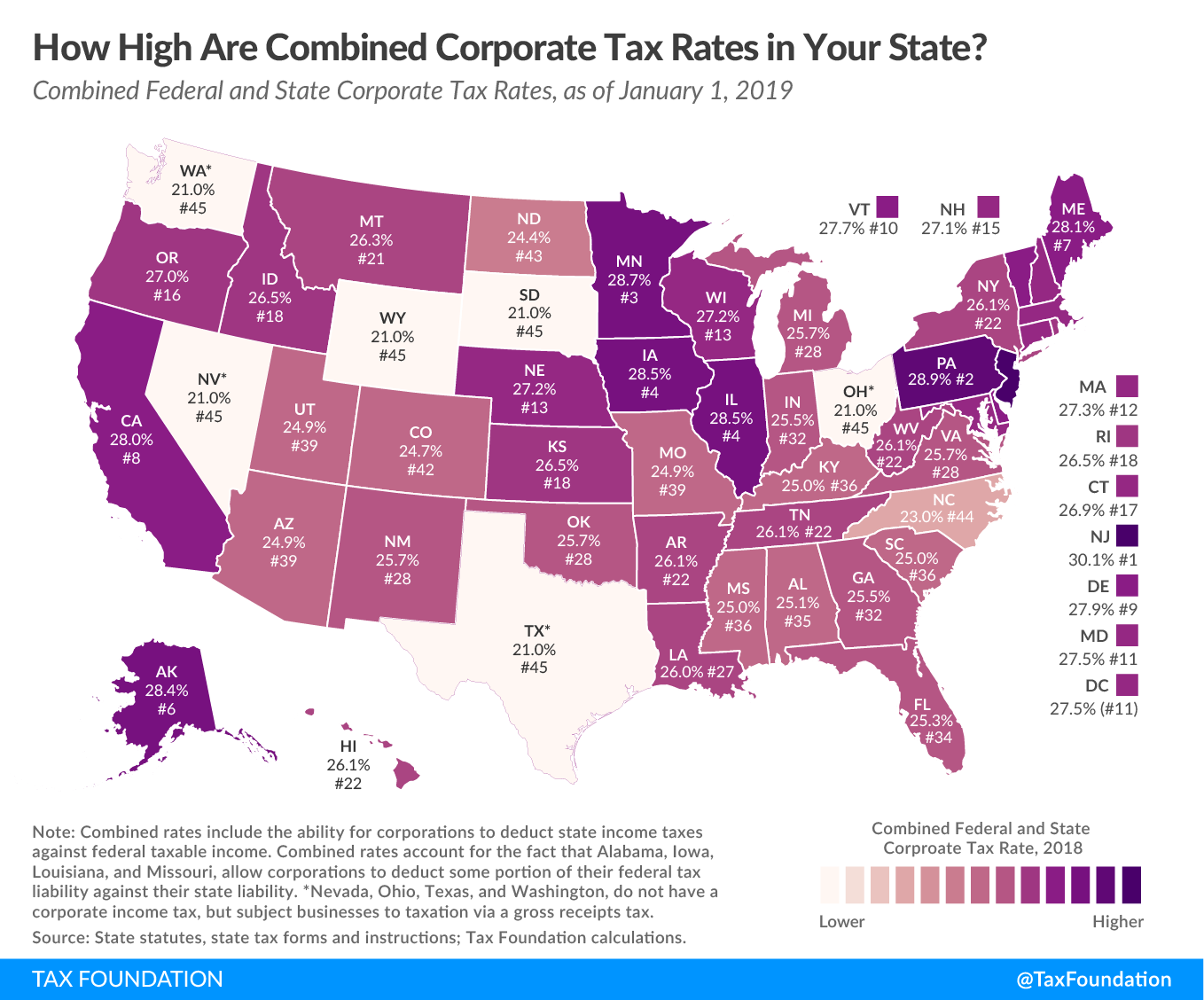

Tax Foundation on Twitter: "A higher U.S. corporate tax rate would also exacerbate the current double taxation of corporate income. When accounting for both levels of tax, under current law, corporate income

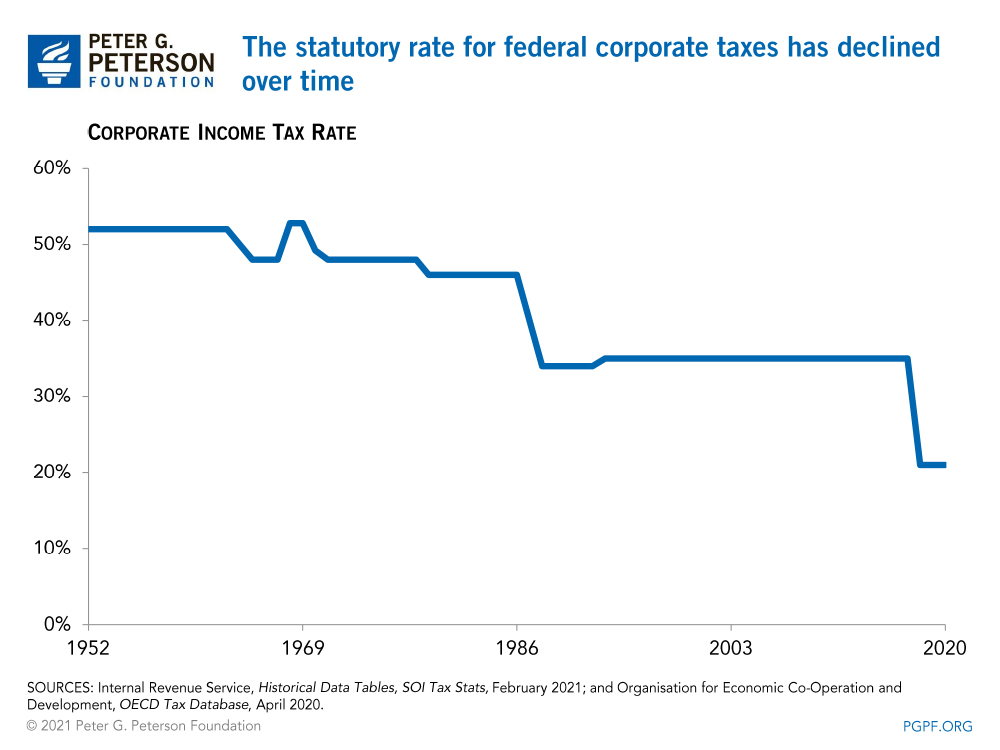

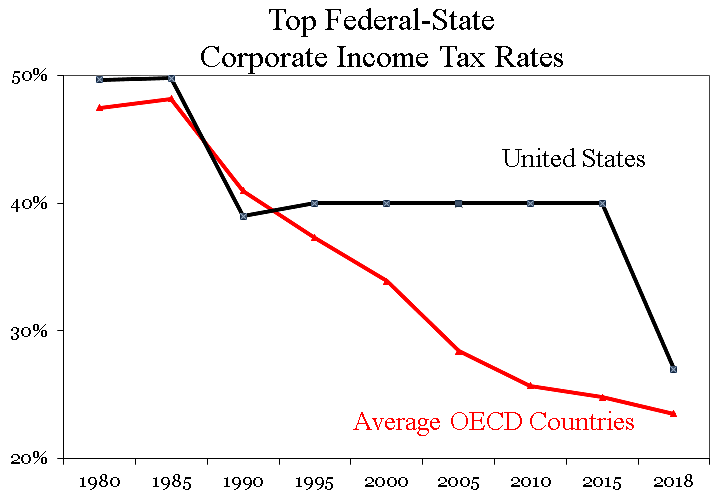

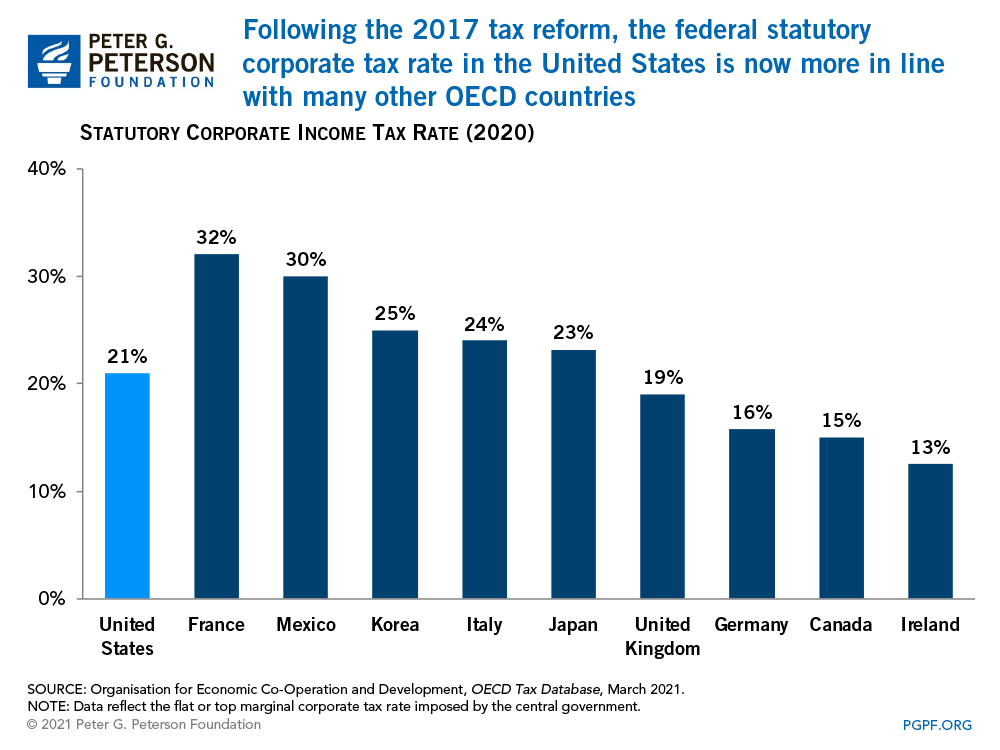

How do US corporate income tax rates and revenues compare with other countries'? | Tax Policy Center

:max_bytes(150000):strip_icc()/dotdash_Final_Countries_with_the_Highest_and_Lowest_Corporate_Tax_Rates_Nov_2020-02-2d1d9e3a2450426893a7cb627c44baf9.jpg)